BIIC for everyone.

The partner of success.

Who are we?

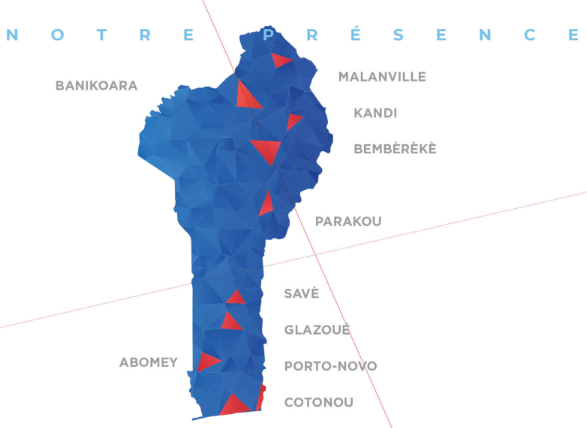

The nearest bank

Who are we?

BIIC is a universal bank with capital of 82,514,000,000 FCFA. born from the merger of BAIC and BIBE.

More than a bank, a real financial partner. Years of knowledge, along with care and attention, bring us the best results for our clients.

More than a bank, a real financial partner. Years of knowledge, along with care and attention, bring us the best results for our clients.

Our services

-

Individuals

The personal account plays an almost essential role in our everyday lives: receiving payments, spending or saving your money, taking out loans, etc.

A private bank account is therefore intended to centralize your entries, your exits and your stocks of money, over the long term. It also serves as a support for the use of numerous means of payment: the bank card of course, but also checks, transfers, etc. It is also possible to make transfers in several currencies. -

Professionals

A business bank account tracks the transactions carried out by a company with its bank. It allows the recording of professional transactions: payment of supplier invoices, collection of customer invoices, payments of taxes and social charges, payments of remuneration to managers, etc. It is generally the legal representative of the company (CEO, manager, business manager, etc.) who requests the opening of a professional account. A certain number of supporting documents must be provided, including proof of identity, address and activity. -

Businesses

A business bank account is an account intended for business purposes. It is open in the name of a business and is used for business-related transactions, rather than personal finances. Unlike a personal account, a business bank account has certain features and offers services tailored to the specific needs of business owners.

A business bank account could also give you the ability to process salary payments and receive credit card payments. -

Associations

An association always generates financial flows, even if they are minimal. He must therefore open a bank account: this is generally one of the first steps taken by the association.

The banker provides a set of payment methods and a range of services, useful for daily operation and the development of activities. Establishing good relationships with this privileged partner is essential.

Numbers Keys

-- --

MORE

560

COMPANIES CONSULTED

COMPANIES CONSULTED

Satisfied customers who testify.

MORE

230

PARTNERS

PARTNERS

A solid network to support you.

MORE

98 %

OF SATISFACTION

OF SATISFACTION

Success is our goal.

Our History

EARLY 2014

Application for a universal banking license to the Central Bank of West Africa (BCEAO) by the BAIC.

November 6, 2015

Start of operations with a base capital of 10 billion XOF (20 million US dollars).

2017 & January 2018

Capital increase to 14 billion FCFA (28 million USD) upstream of the new Basel II & III regulations.

END 2018

BAIC’s participation thus far in a series of milestone Infrastructure Development Transactions (PPPs) in syndication with other local banks.

2020

Decisive turning point in the life of BAIC with its rapprochement and merger with BIBE, giving birth to BIIC, a new bank for a new horizon.